A Comprehensive Look at Galaxy Project Token Unlocks.

Overview of the Galaxy Project and Its Token Unlock Structure.

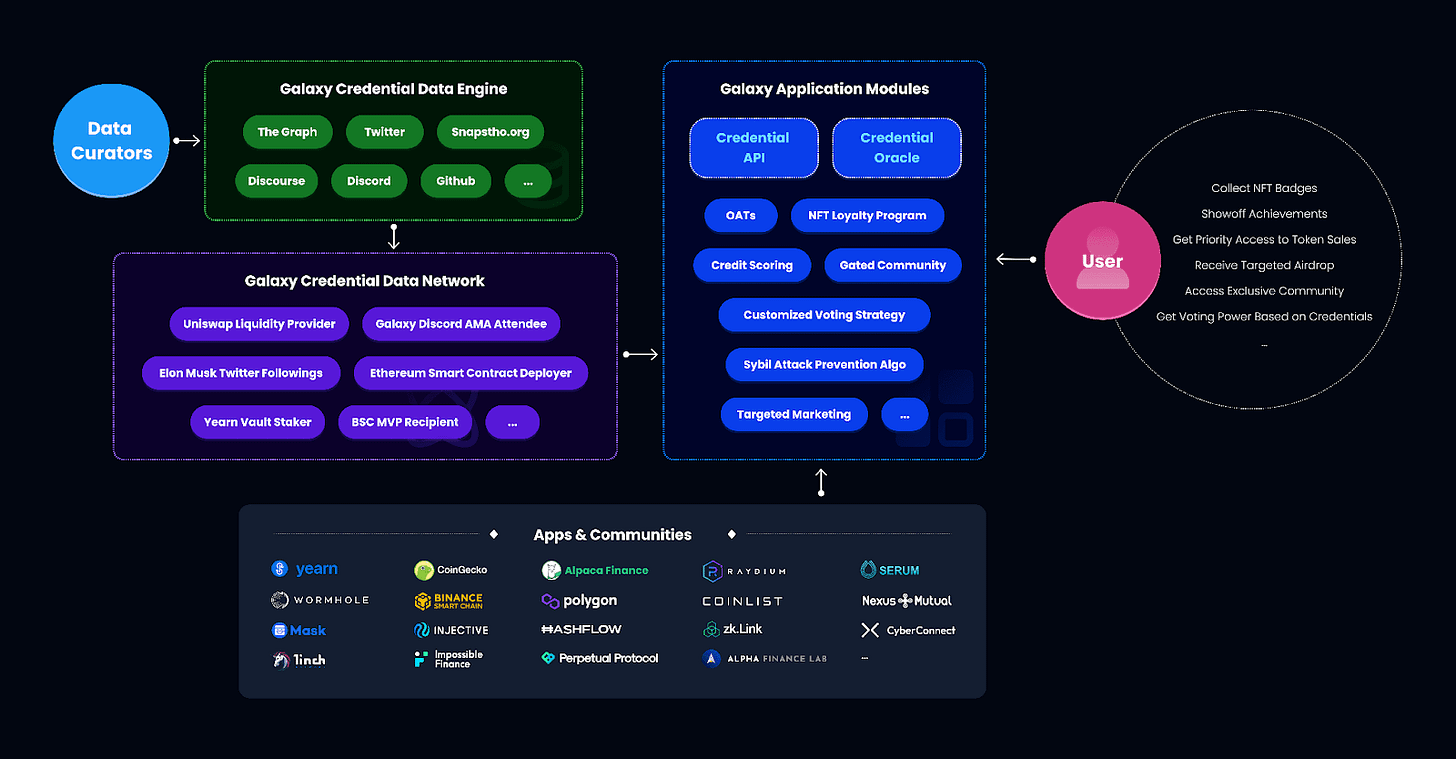

Project Galaxy is a platform that helps Web3 projects and developers improve their products and communities using credential data. Credential data is information that makes up our digital identity, like records from financial institutions or voting history. Currently, this data is often kept in private databases that are only accessible to certain parties, making it difficult for people and companies to use it. Project Galaxy wants to create an open, collaborative network for credential data that can be used by all Web3 developers. Essentially, it's a way for developers to access and use data about people's digital identities in order to build better products

Credential data can come from different sources, including the blockchain and private databases, and can be used by developers to build better products and communities. Contributors to the network can be rewarded if the credentials they provide are used by other developers on the platform. The platform also includes a tool called the Galaxy ID, which allows users to display their credentials and allows developers to build customized features for their products based on those credentials. Finally, the platform offers a tool called the Galaxy on-chain achievement token (OAT) which allows event organizers and community managers to easily create and distribute digital badges, called NFTs, to reward community members. The OAT is meant to be a record of all a person's achievements, both online and offline. For better understanding take a look at Graph below:

So, in short, Project Galaxy is a platform that allows people to contribute data about digital identities and be rewarded for it, and allows developers to use that data to build better products. It also includes tools for creating and distributing digital badges and for displaying and using credentials.

Galxe offers several services that data consumers can use to leverage credentials, including Application Modules, the Credential Database Engine, and the Credential API. These services can be used for a variety of purposes, such as implementing Galxe On-chain Achievement Tokens (OATs), creating NFT loyalty programs, running growth hacking campaigns, managing gated communities, and customizing governance. Developers can also utilize the Credential Database Engine and Credential API to build specialized applications, such as credit scoring algorithms and sybil attack prevention tools. https://www.imperva.com/learn/application-security/sybil-attack/

1. Token sales and economics

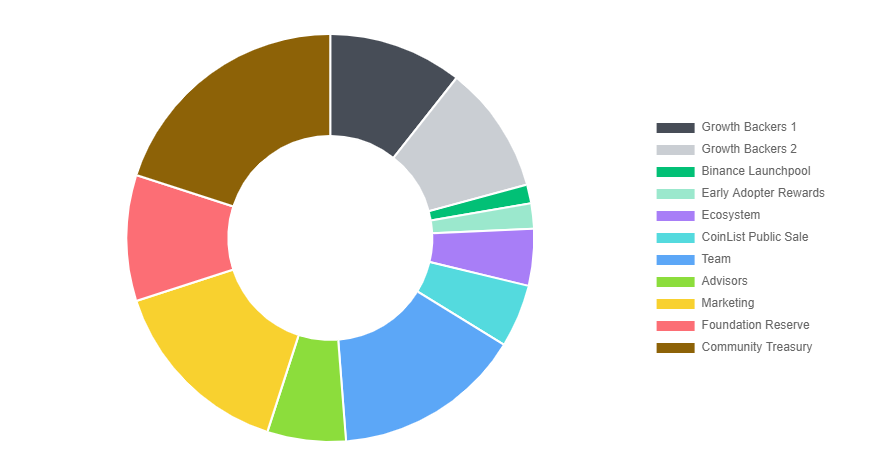

1.1 Token Distribution

GAL token allocation

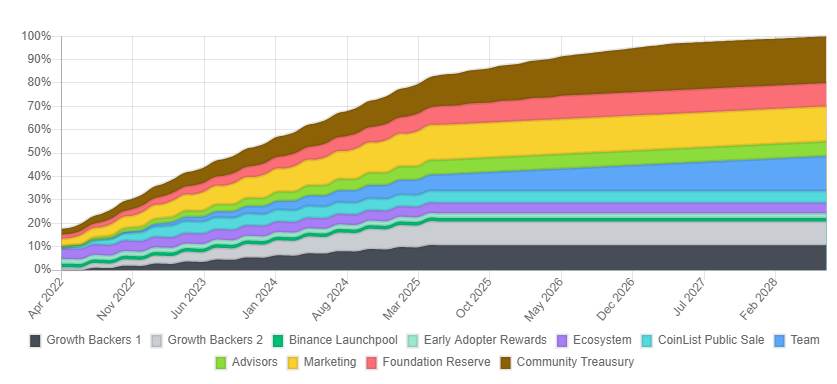

GAL token release schedule

What are Token Unlocks Exactly?

Token unlocks refer to the release of a batch of tokens that were previously held in reserve or were subject to some form of lock-up period. Token unlocks can be used to grant access to certain features or content on a website or platform, or to fund the development and growth of a cryptocurrency or blockchain project. Token unlocks may be implemented using blockchain technology and can be structured in a variety of ways, such as through smart contracts or vesting schedules. Token unlocks can have both positive and negative effects on a project, and it's important for projects to carefully consider the potential risks and consequences of implementing token unlocks.

There are a few ways in which token unlocks could potentially be detrimental to a cryptocurrency or blockchain project:

Price manipulation: If a large number of tokens are released at once, it could potentially flood the market and lead to a decrease in the value of the cryptocurrency. This could be exploited by unscrupulous actors to manipulate the price of the cryptocurrency for their own benefit.

Lack of transparency: If the terms and conditions of the token unlocks are not clearly communicated to the public, it can cause confusion and mistrust among investors and users. For example, if a team behind a project decides to sell the tokens before the agreed upon date of release, it can lead to frustration and disappointment among those who were anticipating the token unlock. It is important for projects to be transparent and open about their plans for token unlocks in order to maintain the trust and confidence of their investors and users.

Misalignment of incentives: If the token unlocks are not structured in a way that aligns the interests of the project's developers and investors, it could lead to conflicts of interest and undermine the long-term viability of the project.

Role of #GAL

The GAL token plays a crucial role in the Project Galaxy ecosystem as it serves as the governance token, incentivizes user participation, and acts as the primary means of payment within the ecosystem.

There are a total of 200,000,000 GAL tokens in circulation. So far, 31% of the GAL tokens have been unlocked, which is approximately $67 million in value. The remaining 69% of the tokens, valued at around $138 million, are scheduled to be unlocked in the future. On January 5, 2023, an additional 0.64% of the tokens, or 3.66% of the Future Development Pool (FDV) worth approximately $1.39 million, will be unlocked.

The details of the unlocks are as follows:

188,615 GAL will be released through the Public Sale (0.09% of the total supply)

596,621 GAL will be released from the Treasury (0.30% of the total supply),

500,034 GAL will be released to the Team (0.25% of the total supply)

The vesting periods for the Public Sale, Treasury, and Team token unlocks are currently in progress. As of now,

6.60 million out of the 10 million GAL tokens allocated for the Public Sale have been unlocked, and there are 120 days left before the vesting period is completed.

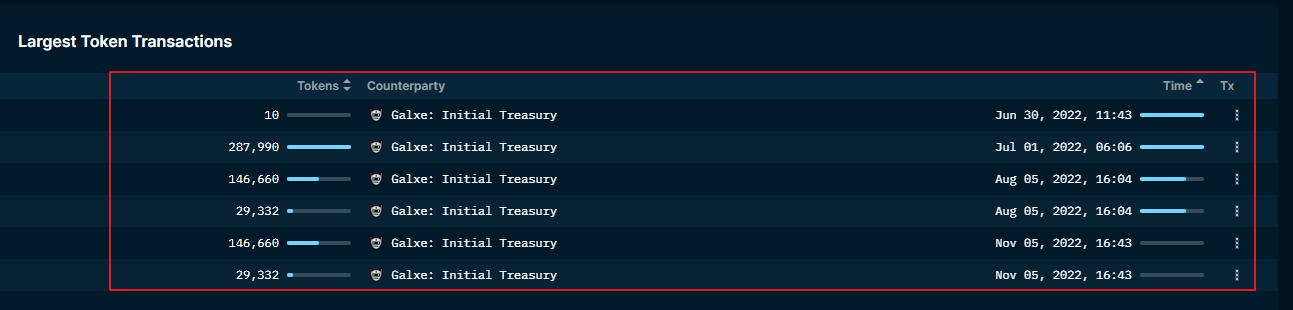

For the Treasury, 8.98 million out of the 40 million GAL tokens have been unlocked, and there are 1552 days left until the vesting period is finished.

The Team tokens have had 2.50 million out of the 30 million GAL tokens unlocked, and there are 1643 days left until the vesting period is completed. It's worth noting that the vesting periods for these token unlocks may be subject to change based on various factors, such as the achievement of certain milestones or the completion of certain tasks.

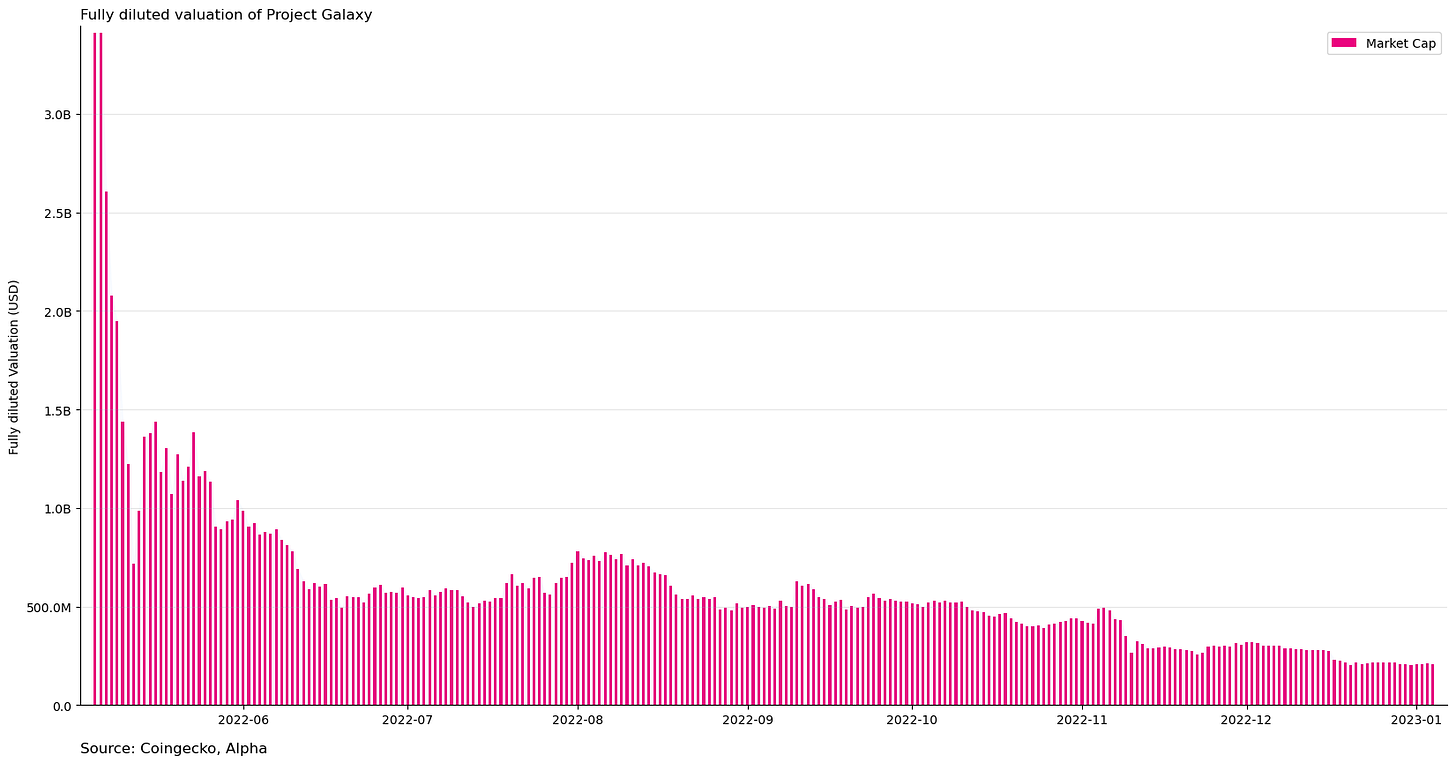

Understanding the Complexities of Fully Diluted Valuation

Token fully diluted valuation (FDV) is a measure of the value of a cryptocurrency or blockchain project's tokens if all of the tokens were to be fully released into circulation. FDV takes into account not only the tokens that are currently available for trading, but also any tokens that are held in reserve or subject to vesting periods or lock-up periods.

One way in which FDV can impact the price of a token is by affecting the supply and demand dynamics in the market. If the FDV of a token is much higher than the current market capitalization (market cap), it could potentially indicate that there is a large amount of supply waiting to be released into the market. This could put downward pressure on the price of the token as the additional supply becomes available for trading. On the other hand, if the FDV is much lower than the market cap, it could suggest that there is limited additional supply available, which could potentially increase demand for the token and lead to an appreciation in price.

It's worth noting that FDV is just one factor that can influence the price of a token. Other factors, such as the overall market demand for the token, the perceived value of the project, and the specific terms and conditions of any token unlocks, can also have an impact on the price. Additionally, the gap between FDV and market cap can vary significantly depending on the specific circumstances of the project. By carefully analyzing all available information, investors can make more informed decisions about whether to buy, hold, or sell a token.

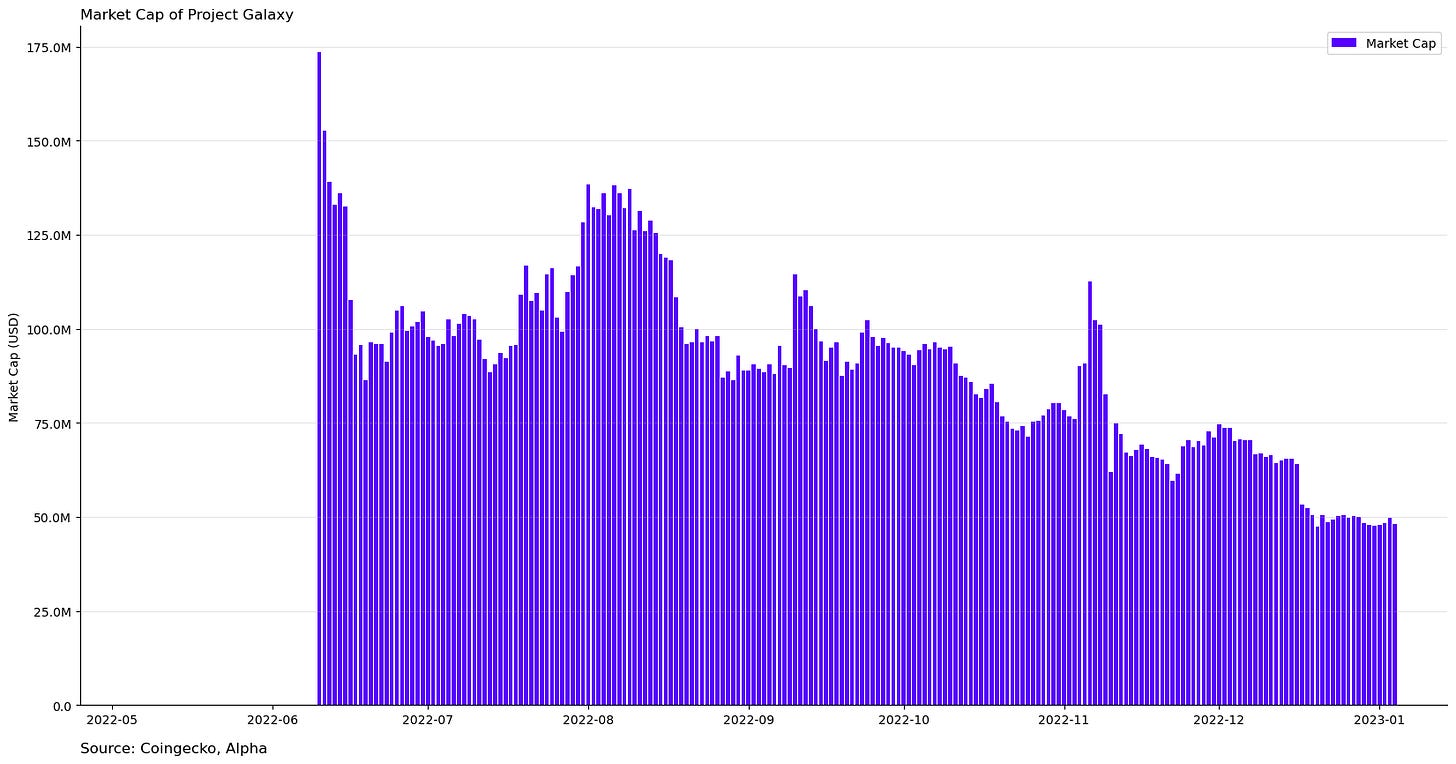

GAL Fully diluted Valuation & Market Cap

GAL market cap is 58.7million and fully diluted valuation is 158million. The large gap between the fully diluted valuation of GAL and its market capitalization of 58.7 million suggests that there is a significant amount of outstanding Tokens that have yet to be issued. In this case, it appears that there are approximately 158 million tokens that are sitting in wallets and are set to be unlocked in the future according to a vesting schedule.

This information is important for investors to consider when evaluating the potential value of GAL. If a large number of these outstanding tokens are unlocked in the future, it could significantly dilute the value of existing shares and potentially impact the token price. It's important for investors to carefully review the vesting schedule and understand the potential impact of these outstanding Tokens on the value of their investment.

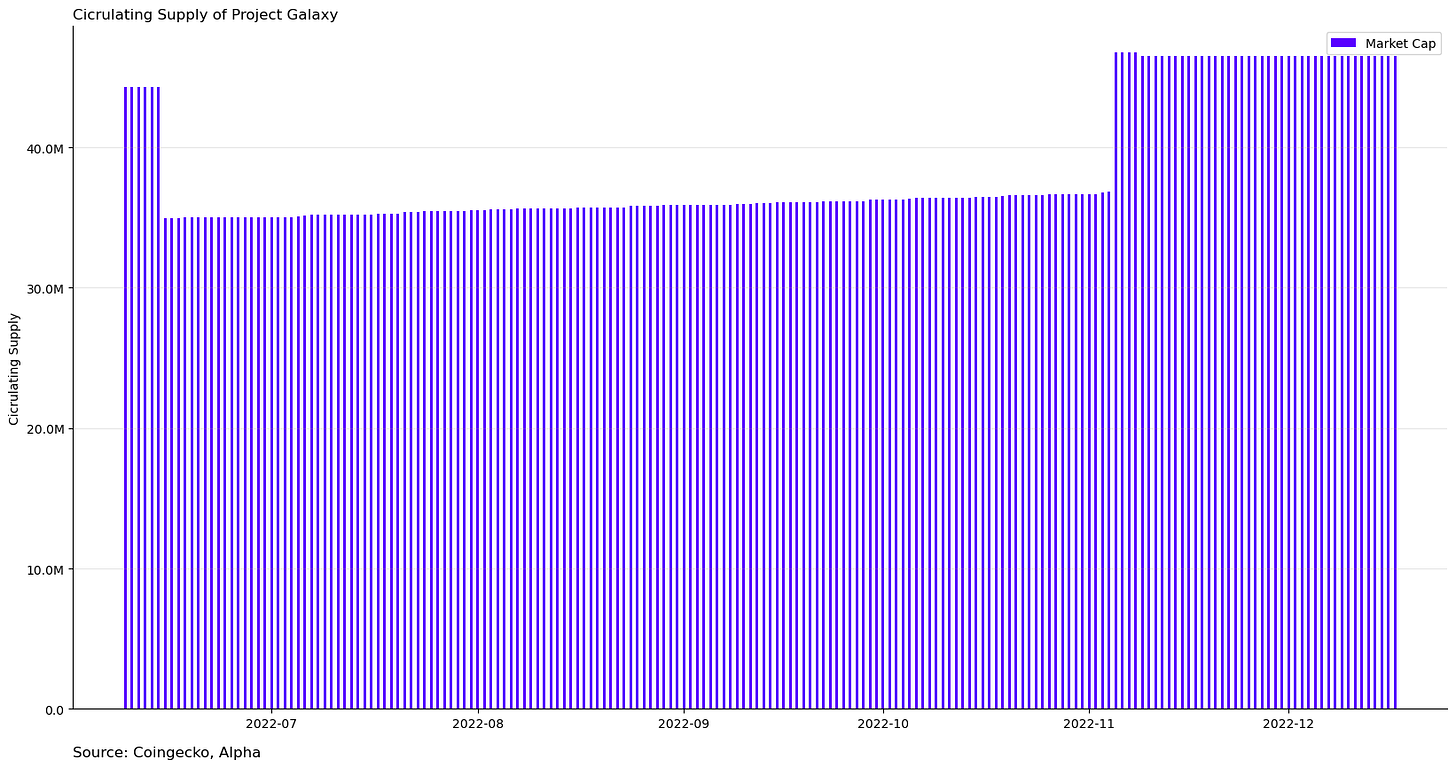

Circulating Supply

There is a total supply of 200,000,000 GAL tokens, and 46 million of these tokens are currently in circulation. (As shown in graph above) This means that there are 154 million GAL tokens that are not currently being traded on the market.

It's important to note that the number of tokens in circulation can impact the demand and price of a token. If there is a high supply of tokens and a low demand for them, the price of the token may be driven down. On the other hand, if there is a low supply of tokens and a high demand for them, the price may be driven up. In the case of GAL, it's possible that the large number of tokens not currently in circulation could have an impact on the token's price in the future, depending on the demand for the token and the rate at which the remaining tokens are released into circulation.

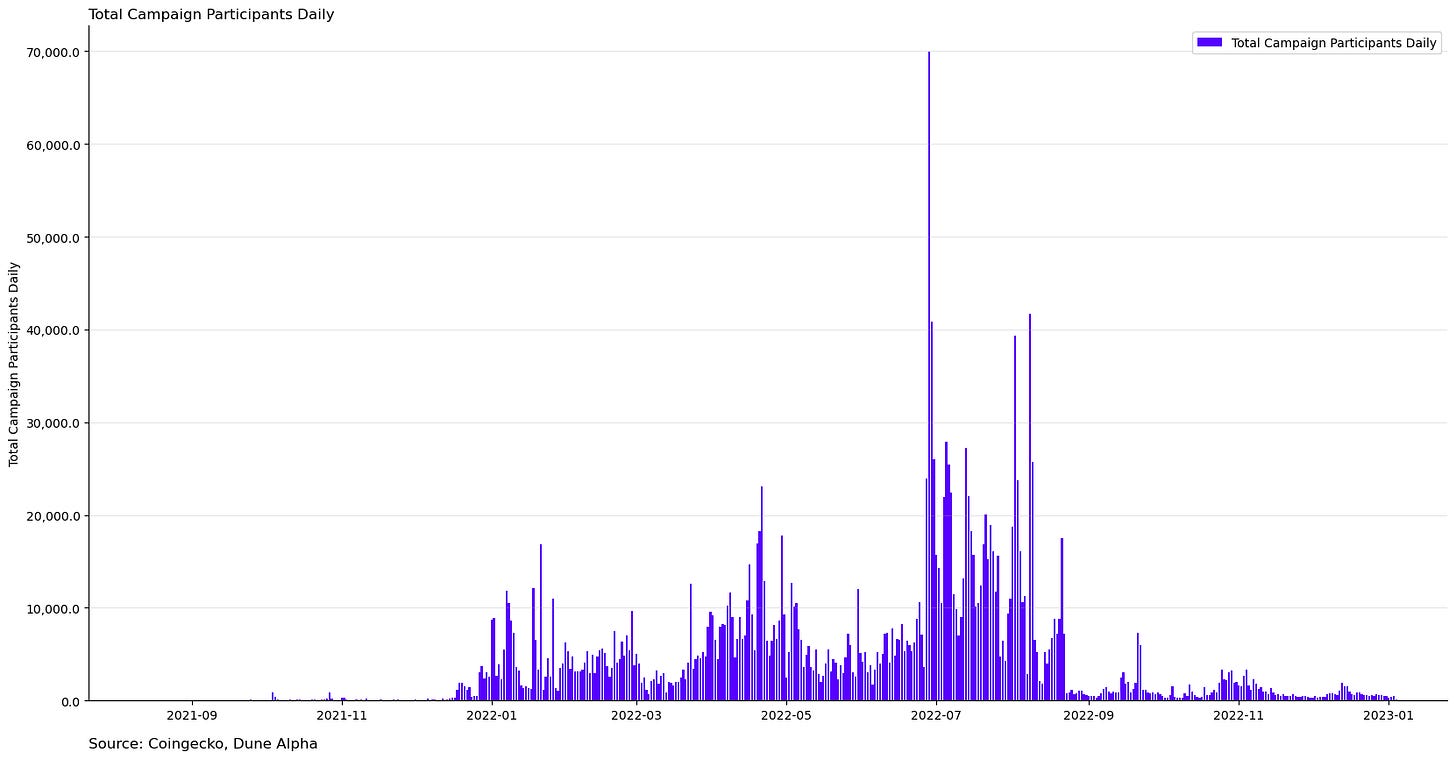

Project Market demand User analytics and metrics

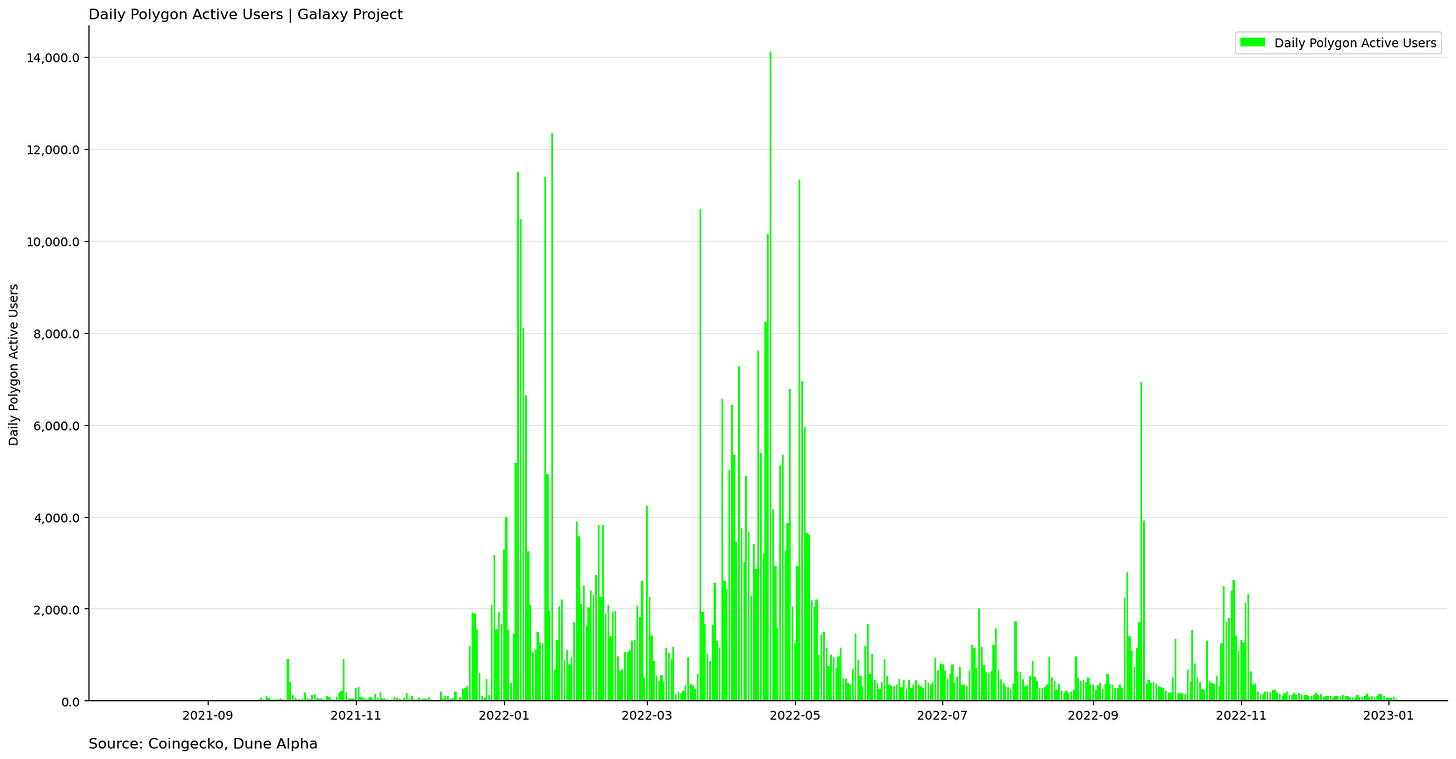

Currently, the number of daily campaign participations is ranging between 300-900, which is significantly lower than the all-time high of 50,000 daily campaigns on July 2022. It appears that the number of daily campaign participations has decreased since the all-time high. Shows lack of interest from New participants.

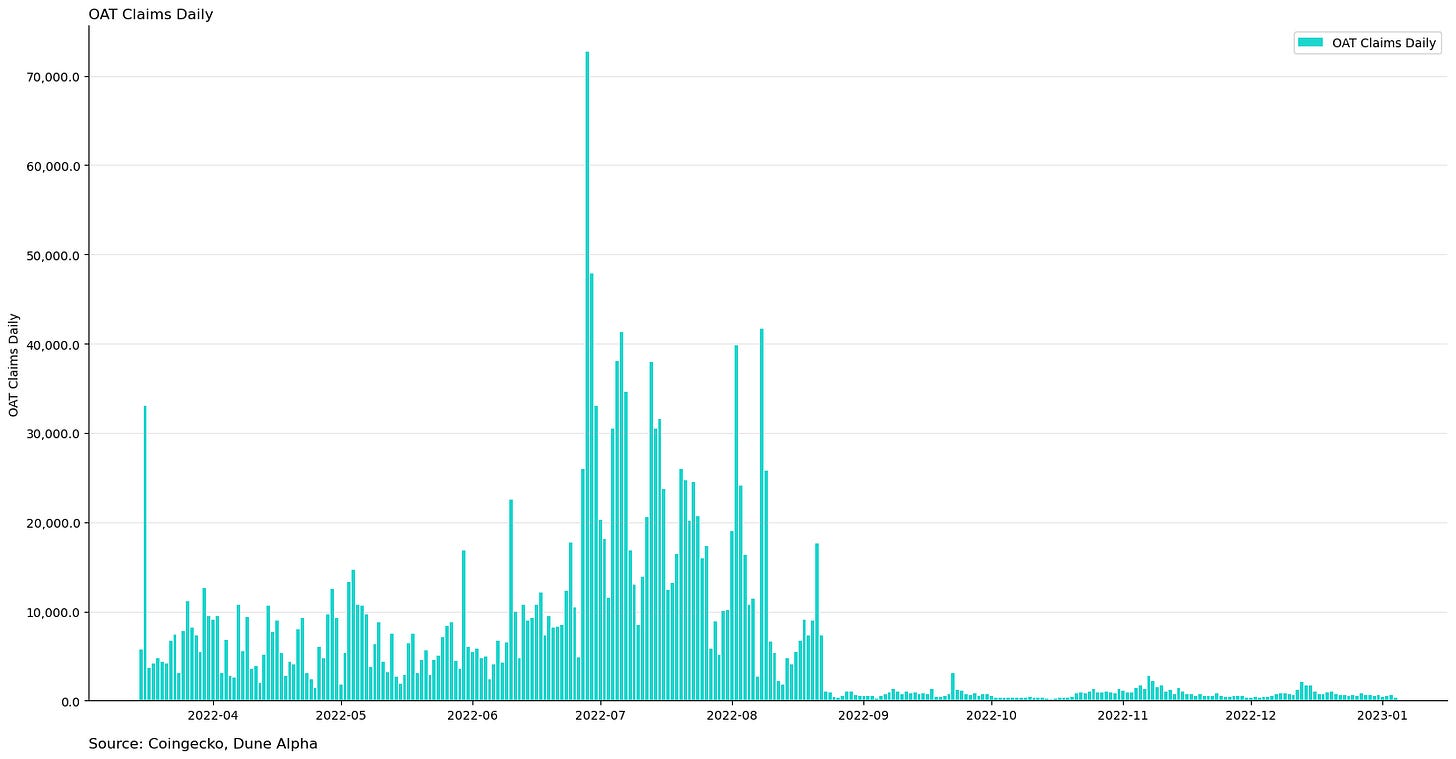

Galxe OAT is for creating and distributing digital badges, known as NFTs, to people who participate in events or activities. Event organizers can create events and badges on the Galxe website and participants can claim their badges by email. Recently, the number of OAT Claims has been low, ranging from 300-600 per day, indicating a decrease in demand and usage of the platform compared to July 2022. (as shown in Graph below)

Galaxy has not seen much activity on its platform recently, with daily users on Polygon numbering only 100-400. Other metrics show similar low levels of user activity.

It is clear that the Galaxy project is struggling to attract and retain users. Without a significant increase in adoption, the project may struggle to achieve its goals and maintain its viability in the long term. Also might loss more value of their Governance token #GAL It will be important for the project's team to identify and address the factors contributing to the low level of user activity in order to turn the situation around.

The Gal Galaxy Token has seen a significant decline in value since its launch, with a drop of 94% according to data from Coin Gecko. This is not unusual in the cryptocurrency world, as many blockchains and tokens have experienced similar declines of 80% to 95%. However,

The Gal token, on the other hand, is still down 94% and faces the additional challenge of 68% of its tokens being unlocked in the future. It will be interesting to see how the Gal project and its token survive this downturn and whether they will need to alter their rules and roadmap in order to create a more user-friendly and community-oriented token system.

Given the current state of the market and the challenges faced by the Gal token, it is important for the project team to carefully consider their strategies for moving forward. This may include reevaluating their goals and priorities, seeking out new partnerships and integrations, and finding ways to increase adoption and usage of the Gal token.

Overview of the Gal token's on-chain activity

In this analysis, we will be examining the on-chain activity of the Gal token over the past few days. Specifically, we will be tracking the movements of the main whale and project ecosystem wallets, including those belonging to the team, investors, advisors, and other entities. By analyzing the size and frequency of these transactions, we can gain insight into the health and vitality of the Gal ecosystem.

I will be utilizing the Nansen platform to visualize and track the on-chain activity of the Gal token. By using this tool, I hope to make the information more accessible and easier for readers to understand. Nansen's clear and intuitive interface allows us to present the data in a concise and visually appealing way, saving time and effort for both ourselves and our readers.

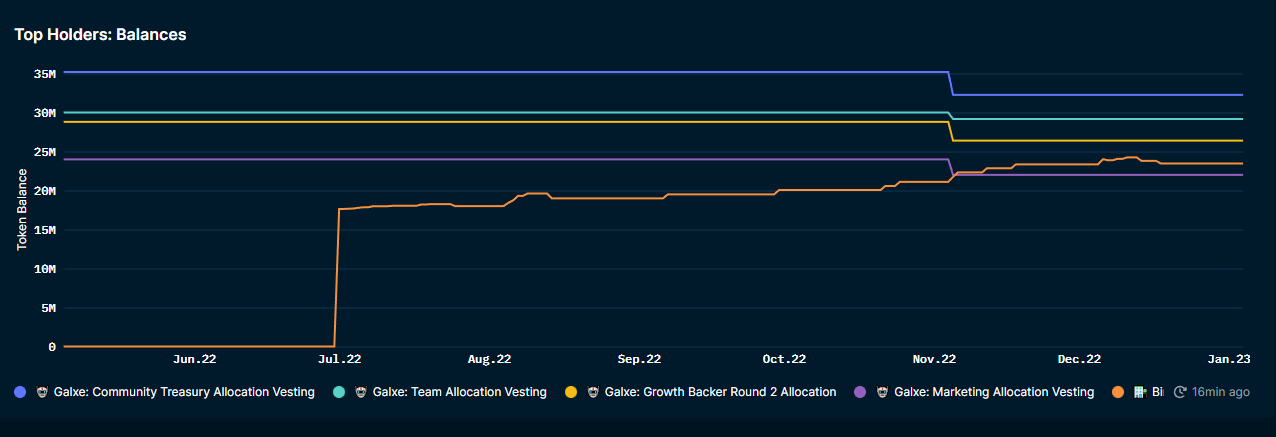

Token Distribution:

The top holders of the Gal token are currently the Galaxy Treasury wallet, holding 16% of the supply, and the Team Allocation Vesting wallet, holding 15% of the supply. These two wallets are followed by the Growth Backer Investor from Round 1 wallet, which holds 9% of the supply, the Growth Backer Investor from Round 2 holds 13% of the supply. the Marketing Allocation wallet, which holds 11%. And the Galaxy foundation wallet holds 8.2% of the supply,

Together, these major players hold a significant portion of the Gal token supply, totaling almost 72%. This concentration of ownership can be seen as a red flag, as it suggests that a small group of stakeholders, including the team and investors, hold a disproportionate amount of influence over the project. This may not be seen as community-friendly, as the interests of these major holders may not always align with those of the broader community.

On a positive note, the large holding of the Galaxy Treasury wallet could be seen as a sign of the project's financial stability and ability to fund its operations and development. However, it will be important for the project to strike a balance between maintaining a healthy treasury and ensuring that the distribution of tokens is fair and transparent.

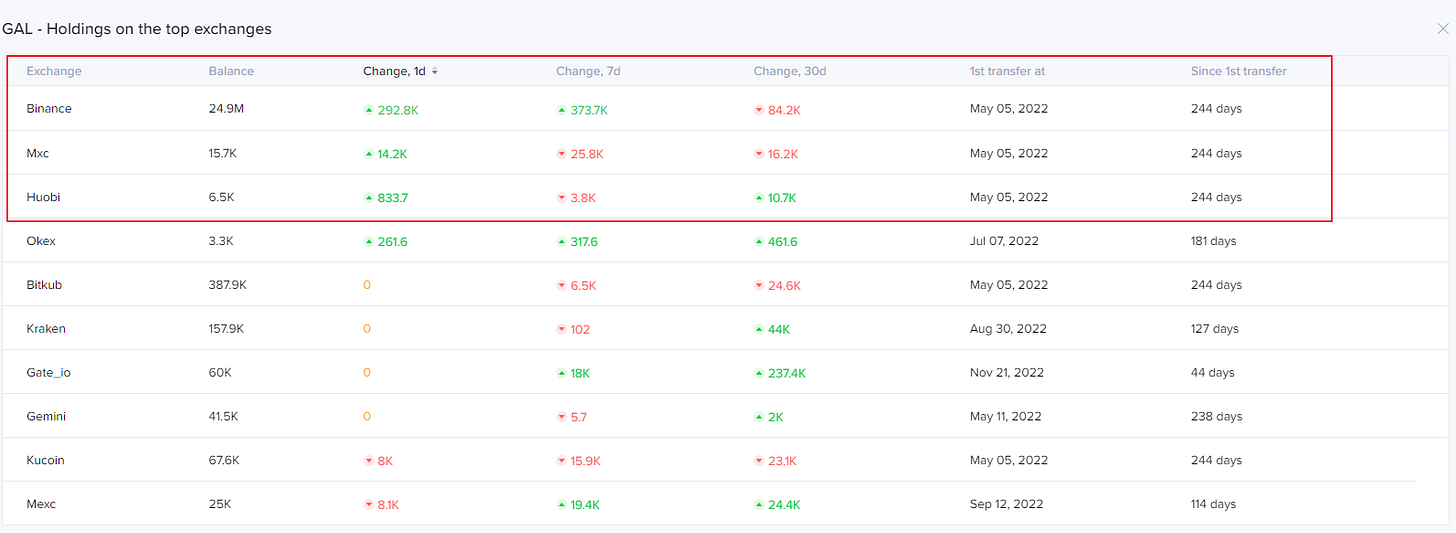

Exchanges Activity

There has been a significant increase in the number of GAL token deposits on central exchanges (CEX) over the past 24 hours, with a 707% increase in volume. Currently approximately $33 million worth of GAL tokens Sitting on CEX exchanges, or roughly 17% of the total supply.

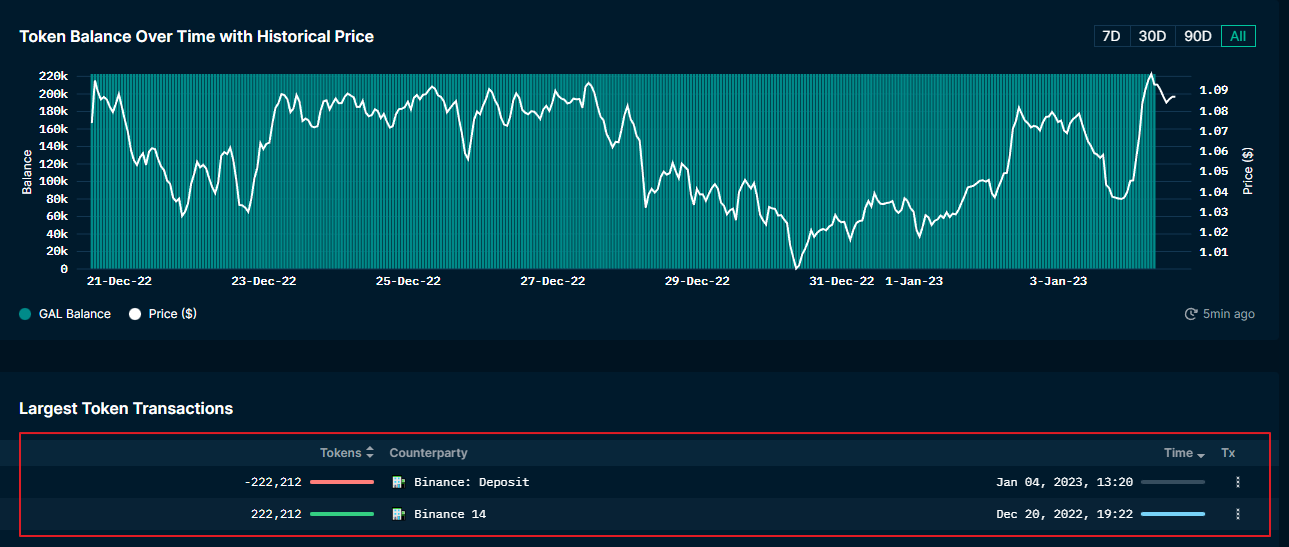

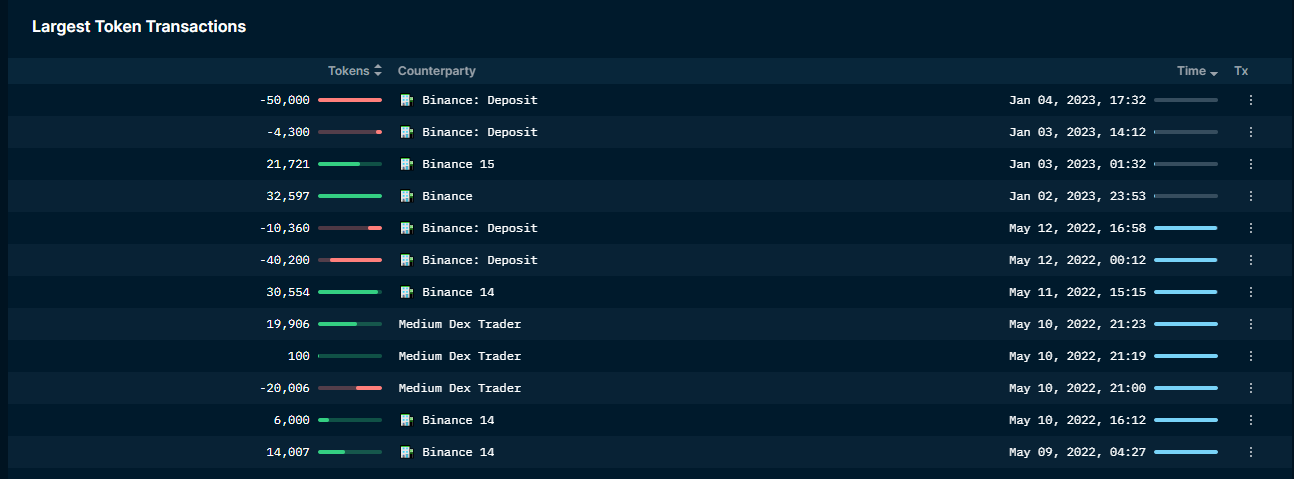

The largest exchange for GAL deposits over the past 7 days has been Binance, which saw a total of 374,176 GAL tokens deposited. A closer look at the data reveals that two high balance wallets were responsible for the majority of these deposits. One wallet deposited 50,000 GAL tokens to Binance, while another deposited 222,212 GAL tokens. It is unclear at this time what the motivations behind these large deposits may be, but they could potentially indicate a shift in market sentiment or a change in the strategies of major holders.

The Nansen wallet balance graph appears to be lagging Just Ignore it.

The second wallet that made large deposits of GAL tokens to Binance has been holding these tokens since May 2022. The wallet made the deposits between January 1st and January 4th of this month.

Funds Involvement :

The Spartan Group has received a number of GAL tokens over the past year, with some arriving in July and others in August. The group currently holds a total of $694k worth of GAL tokens.

It is worth noting that the Spartan Group has not been actively selling or transferring these tokens to other wallets. This could indicate that the group is holding onto the tokens for the long-term, possibly as part of a larger investment strategy. It may be worth monitoring the Spartan Group's wallet for any potential activity this year, as any changes in their holdings or movements of the tokens could provide insight into their plans and intentions.

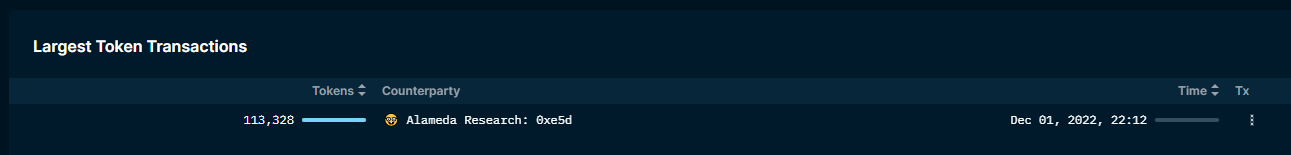

Alameda Research:

They are holding 113,328 Tokens transferring from main wallet to another by Dec01-2022. worth to monitor their wallet because after bankruptcy they might start selling their holdings

Smart money:

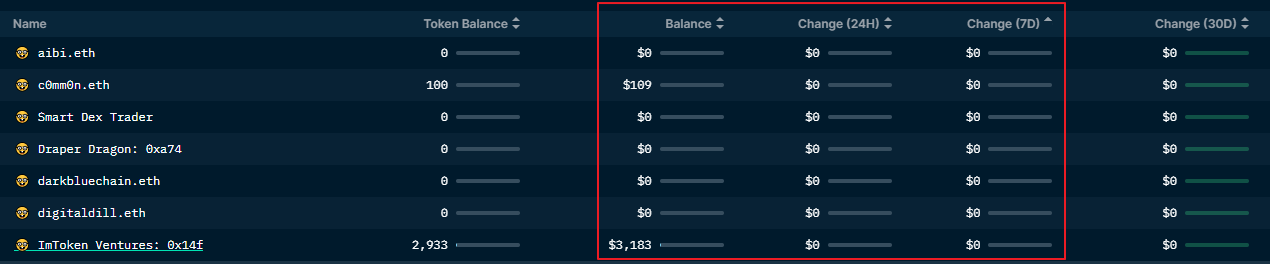

It appears that the accumulation of GAL tokens by "smart money" (i.e. experienced and well-informed investors) has come to a halt over the past 7 days. The data shows no evidence of any wallets accumulating significant amounts of GAL tokens during this time period..

This lack of accumulation could potentially be a sign of a lack of confidence in the GAL project or the broader market. It is possible that smart money investors are currently more cautious or are focusing their attention on other opportunities.

Before Closing Adding Project Main wallets and Whales and fresh wallets who are holding major supply of GAL token. It will be important to monitor the activity of these wallets and to understand their motivations and goals in order to get a clearer picture of the overall health and direction of the GAL project.

GAL (Galaxy)

Fresh_wallet > holds $314k 0xff297F07C18C925AB38C726aB17568f7df19c791

Fresh_wallet > holds $286k 0x9fc1ABb9A5f49F31948D7aF7A82999c41266885B

Galaxy Foundation allocation vesting » 0x0b318030c698fd4875726f2f08714a22b8c5f769

Growth Backer Round 2 Allocation »» 0xc8f03241d10ca39a64492587aa443fb5ac660870

Growth Backer Round 1 Allocation Vesting »» 0xdba0f580521968895cca2b1fded2c5cd6d075882

Galxe: Marketing Allocation Vesting »» 0x0ca389eb320e4ec509dde88310b3c60953721a21

Galxe: Community Treasury Allocation Vesting »» 0x8793c0b5edb1fea27b1aac3f6fcbabd31b5a4ee7

Whale: 0xd8d6ffe342210057bf4dcc31da28d006f253cef0

In conclusion, I hope my Analysis of the on-chain activity and unlocks of the GAL project has revealed a number of interesting trends and patterns. I have identified the major players in the GAL ecosystem, tracked the movements of key wallets, and examined the balance of inflows and outflows of funds. I have also analyzed the size and frequency of transactions, and evaluated the overall health and vitality of the GAL network based on its on-chain activity.

Overall, the data suggests that the GAL project is facing some challenges, including a high concentration of ownership among a small group of stakeholders and a lack of accumulation by smart money investors. However, Future operations and Moves by Galaxy Project would decide Growth for the project.

I hope that this report has provided a helpful and informative overview of the GAL project's on-chain activity and unlocks. Thank you for reading, and we welcome any feedback or comments you may have.

Great job Alpha on your analysis! Your use of statistical methods and ability to convey the data through clear and informative graphs is impressive.

Let's see when this centralized token bites the dust.